Reverse VAT Explained

- By Jacob Orphanou

- •

- 24 Mar, 2023

- •

Previously, anyone that was VAT registered who supplied construction work in the UK would have invoiced money due to them, including a charge for VAT.

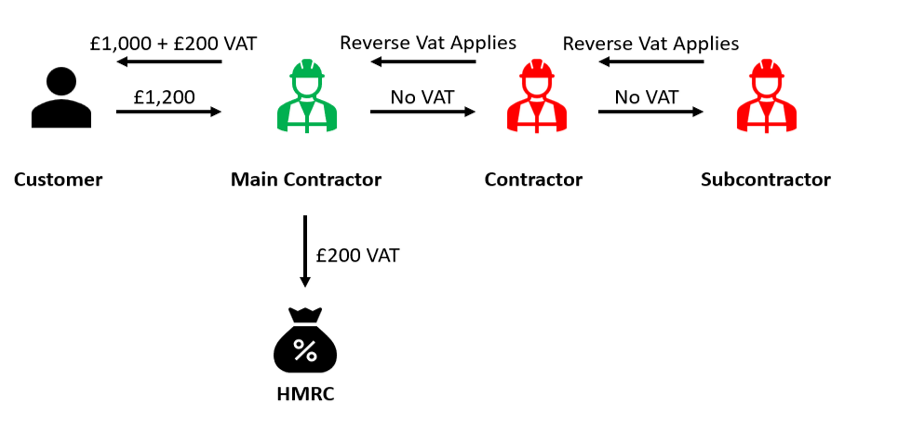

For instance, every £1,000, a VAT registered business currently invoices £1,200. Every three months the business then deducts any VAT incurred from expenses from the £200 and pays the remainder to HMRC or receive a VAT rebate should the VAT on expenses be higher than the VAT on income.

March 2021, things changed. Now the only companies in the construction chain that bill VAT will be those that are contracted with the customer.

All subcontractors to a main contractor will treat the VAT as if it has been accounted for and will not charge any further VAT on their income. However, each quarter they will still be able to claim the VAT on their expenditure.

The below diagram will hopefully give you a clearer understanding to the explanation above.

However, this does not mean that all your work will no longer be inclusive of VAT. As shown above, jobs where you are the main contractor, you will still have to include a VAT charge as normal. There are also a few exceptions to the above diagram. Below is a list taken from the government website outlining when you should and should not use the reverse charge.

When you must use the VAT reverse charge

The list of services in this guide is the same as the list of ‘construction operations’ covered by the Construction Industry Scheme, except for supplies of workers provided by employment businesses.

You must use the charge for the following services:

· constructing, altering, repairing, extending, demolishing or dismantling buildings or structures (whether permanent or not), including offshore installation services

· constructing, altering, repairing, extending, demolishing of any works forming, or planned to form, part of the land, including (in particular) walls, roadworks, power lines, electronic communications equipment, aircraft runways, railways, inland waterways, docks and harbours, pipelines, reservoirs, water mains, wells, sewers, industrial plant and installations for purposes of land drainage, coast protection or defence.

· installing heating, lighting, air-conditioning, ventilation, power supply, drainage, sanitation, water supply or fire protection systems in any building or structure

· internal cleaning of buildings and structures, so far as carried out during their construction, alteration, repair, extension or restoration.

· painting or decorating the inside or the external surfaces of any building or structure

· services which form an integral part of or are part of the preparation or completion of the services, including site clearance, earth-moving, excavation, tunnelling and boring, laying of foundations, erection of scaffolding, site restoration, landscaping and the provision of roadways and other access works.

When you must not use the VAT reverse charge

Do not use the charge for the following services, when supplied on their own:

· drilling for, or extracting, oil or natural gas

· extracting minerals (using underground or surface working) and tunnelling, boring, or construction of underground works, for this purpose

· manufacturing building or engineering components or equipment, materials, plant or machinery, or delivering any of these to site.

· manufacturing components for heating, lighting, air-conditioning, ventilation, power supply, drainage, sanitation, water supply or fire protection systems, or delivering any of these to site.

· the professional work of architects or surveyors, or of building, engineering, interior or exterior decoration and landscape consultants

· making, installing and repairing art works such as sculptures, murals and other items that are purely artistic.

· signwriting and erecting, installing and repairing signboards and advertisements.

· installing seating, blinds, and shutters

· installing security systems, including burglar alarms, closed circuit television and public address systems